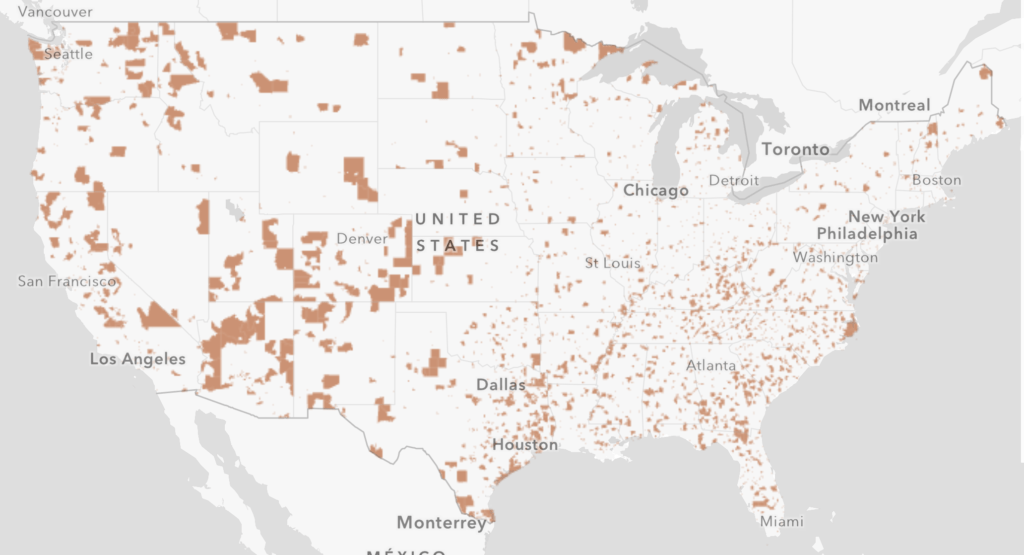

O Zones, or “opportunity zones”, as they are more commonly known have become quite popular in recent years as every city in the United States has created such a zone to lure investors who might otherwise look elsewhere for potential investment properties.

What exactly is an O Zone?

An opportunity zone was created in 2017 thanks to the overhaul of the tax code by President Trump. The goal with opportunity zones is to revitalize communities across the United States using private taxpayer dollars. When an investor sells one of their properties, they can invest the proceeds from the sale of that property into an O Zone and defer having to pay taxes on the sale of their property for several years much like they would with a 1031 exchange.

What’s more, if an investor retains an opportunity zone investment for at least five years, 10 percent of the initial investment is excluded from being taxed. After seven years, that figure increases to 15 percent. “This is being called the biggest tax break in our lifetime,” says Tiffany Lewis, a broker with Synergy Properties in Spokane, Wash., who focuses on working with residential property investors.

Opportunity zones are similar in some ways to 1031 like-kind exchanges, which permit real estate investors to defer taxes on gains from the sale of a property by reinvesting the proceeds from the sale in another property within six months. A key difference is that 1031’s do not allow investors to permanently exclude any portion of their profit from taxes, which the opportunity zone program allows for investments held for at least 10 years.

Huge Investor Appeal

While some of the changes to the tax code are unfavorable to investors living in California, O Zones represent a huge opportunity for investors because the combination of deferring capital gains and potentially enjoying tax-free profits down the road is awesome.

More good news about O Zones is that an investor doesn’t need to live in an O Zone to invest in one. Investors can live in California and invest in O Zones on the East Coast or elsewhere in the Golden State

The key to success before investing in an O Zone is to do your research and know how much private and public investment is happening in the area before you invest there plus you should also know the local zoning laws and where developable lots are in the area you plan on investing in as well.

Contact 36 North Property Management

To learn more about investment opportunities in Monterey County, or to speak with us about our property management services, contact us today by calling (831) 484-4604 or click here to connect with us online.